Fairer Tax Proposal

A sensible solution to our radical wealth problem

The working class in America suffers heavily from the extreme wealth inequality. Replacing the current federal income tax with a progressive wealth tax could dramatically reduce the financial burden on lower- and middle-income families—by as much as 90%—while generating substantially more revenue for the country. Based on current estimates, such a tax could raise approximately $4 trillion annually, compared to the $2 trillion collected through the existing income tax system.

Objective

This proposal aims to solve wealth inequality by outlining a comprehensive and equitable tax solution that can achieve the following goals:

- Significantly reduce the lower and middle class tax burdens

- Implement a progressive and reasonable tax on accumulated wealth

- Generate higher revenue stream to decrease the national debt

The hope is that these principles will garner popular support and serve as a compelling platform for future campaigns.

Current State of Affairs

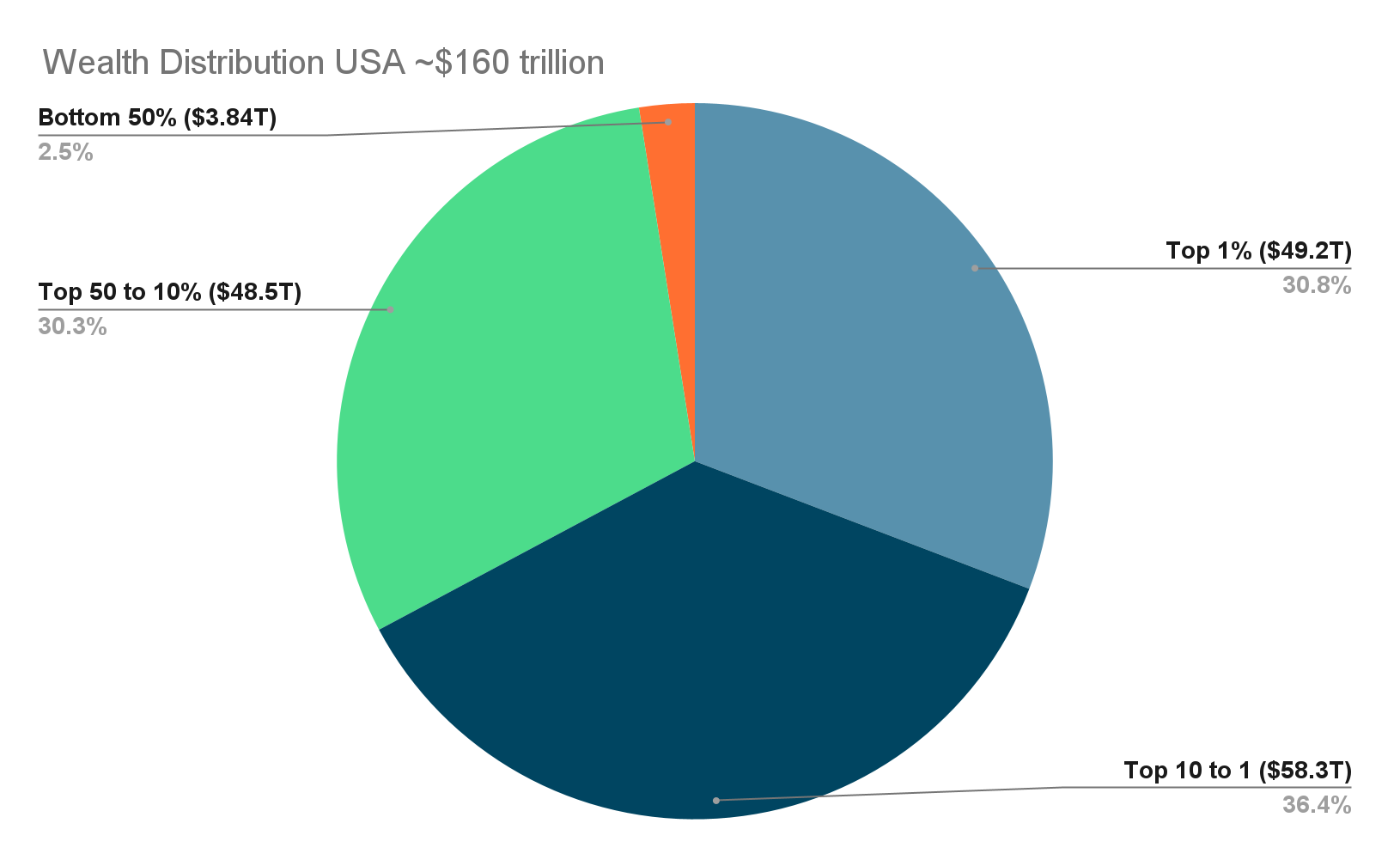

Currently, the working class suffers heavily from the rapidly widening wealth inequality. The adverse effects of having such drastic inequality includes inflation without wage growth, reduced availability of housing units, increasing rent and house prices, increasingly unaffordable healthcare and immense wealth influence over the government. The bottom 90% only holds 32.8% of the nation’s wealth while the top 10% holds roughly 67.2% of total net wealth ($107.5 trillion), and even further, the top 1% holds 30.8% of the wealth ($49.2 trillion), indicating significant concentration at the top.

The contributing factors to this inequality can be listed as followed:

- Current tax models are regressive: Current tax model causes lower classes to pay disproportionately higher amount of money compared to their net worth

- Assets can appreciate far better than cash: Lower class people generally don’t have disposable income to invest with, holding mostly cash, which loses value due to inflation. Meanwhile, wealthier people can simply park their money into investment vehicles that far outpace inflation such as stocks and real estate.

- Unrealized gains are not taxed: Excess wealth can simply be invested into assets, which passively generates more money for the investor without being taxed until sold.

These conditions enable the wealthy to utilize the Buy, Borrow, Die strategy. This practice has historically allowed the wealthy to amass and transfer immense fortunes across generations with minimal to no tax liability. The steps are as followed:

- Buy: Purchase and hold appreciating assets

- Borrow: Instead of selling these assets (which triggers capital gains tax), they borrow money against the appreciated value to fund their lifestyle or investments, the loans are not taxed and the interests on these loans are tax-deductible

-

Die: When the individual dies, the inheritor only needs to pay capital gain tax for gains starting from the original owner’s death, avoiding all appreciation throughout the original owner’s life. For example, if someone bought a property at $100,000, and that property appreciates to $1 million by the time they die, the $900,000 gain does not get taxed.

Proposal

To design a simpler tax model that can relieve the burden on the lower classes, this model proposes the complete elimination of income taxes, which accounts for $2.06 trillion, or 51% of the total federal revenue of $4.01 trillion in 2025. This model will not touch corporate taxes due to OECD agreement, nor will it touch medicaid/social security for societal reasons.

The revenue from income taxes will instead be replaced with a much simpler and effective progressive wealth tax. The wealth tax will look as followed starting at 18 years old (legal working age):

|

Net Wealth Range (USD) |

Marginal Tax |

|

$0 to $1,000,000 |

1% |

|

$1,000,001 to $10,000,000 |

2% |

|

$10,000,001 to $100,000,000 |

3% |

|

$100,000,001 to $1,000,000,000 (Up to $1 billion) |

4% |

|

$1,000,000,001 to $10,000,000,000 |

5% |

|

$10,000,000,001 to $100,000,000,000 |

6% |

|

$100,000,000,001 to $1,000,000,000,000 (Up to $1 trillion) |

7% |

|

Over $1,000,000,000,000 (Over $1 trillion) |

8% |

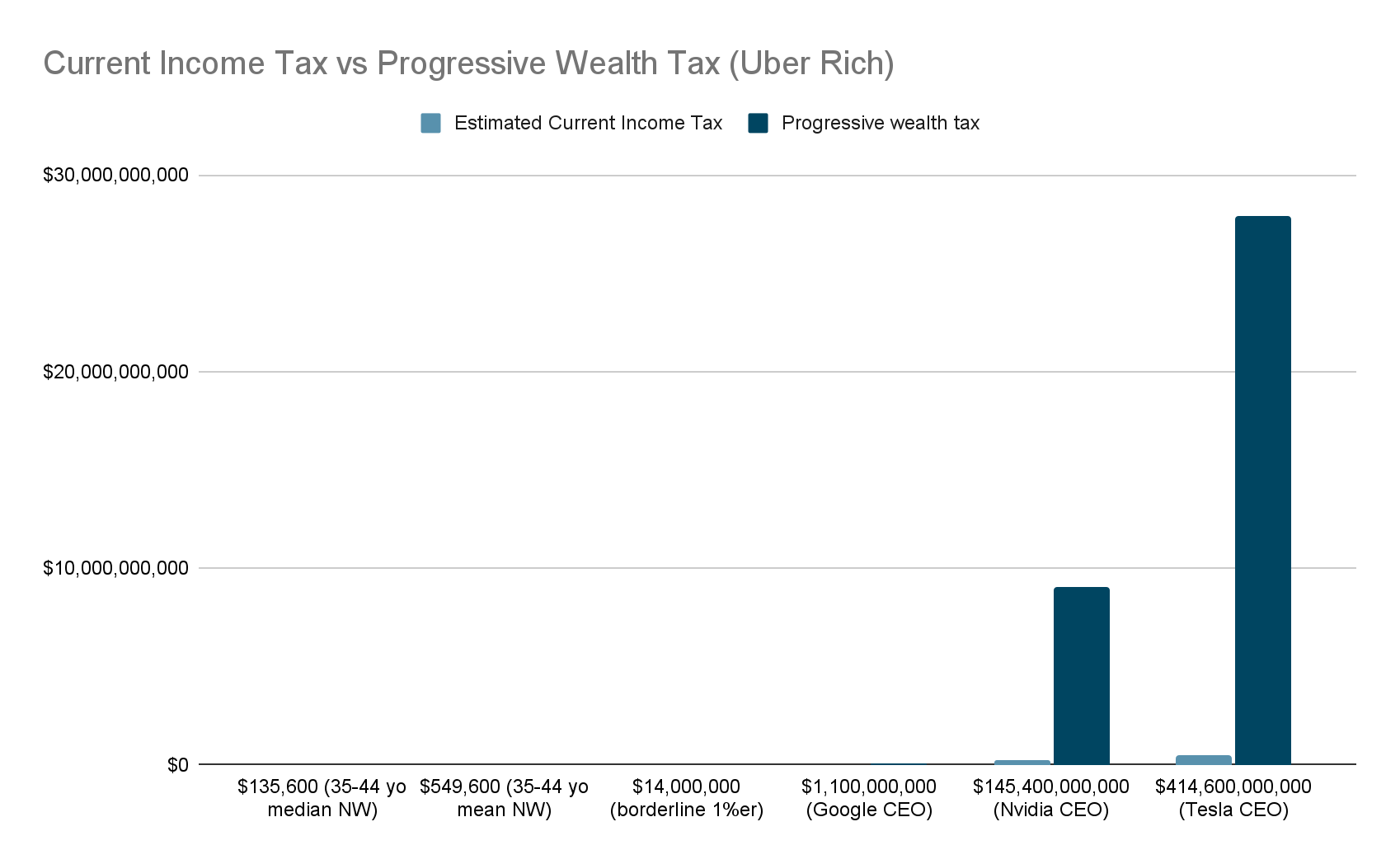

Sample taxes:

|

Individual (Net Worth) |

Estimated Income Tax |

Wealth Tax (% Change) |

|

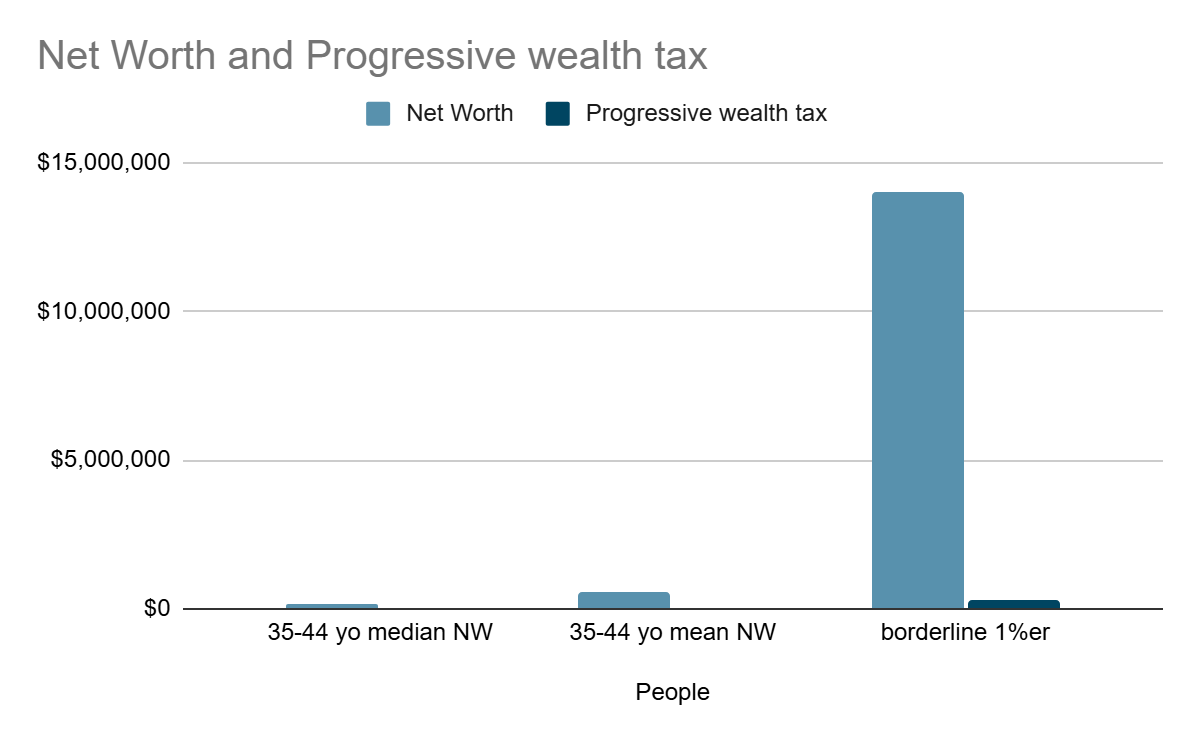

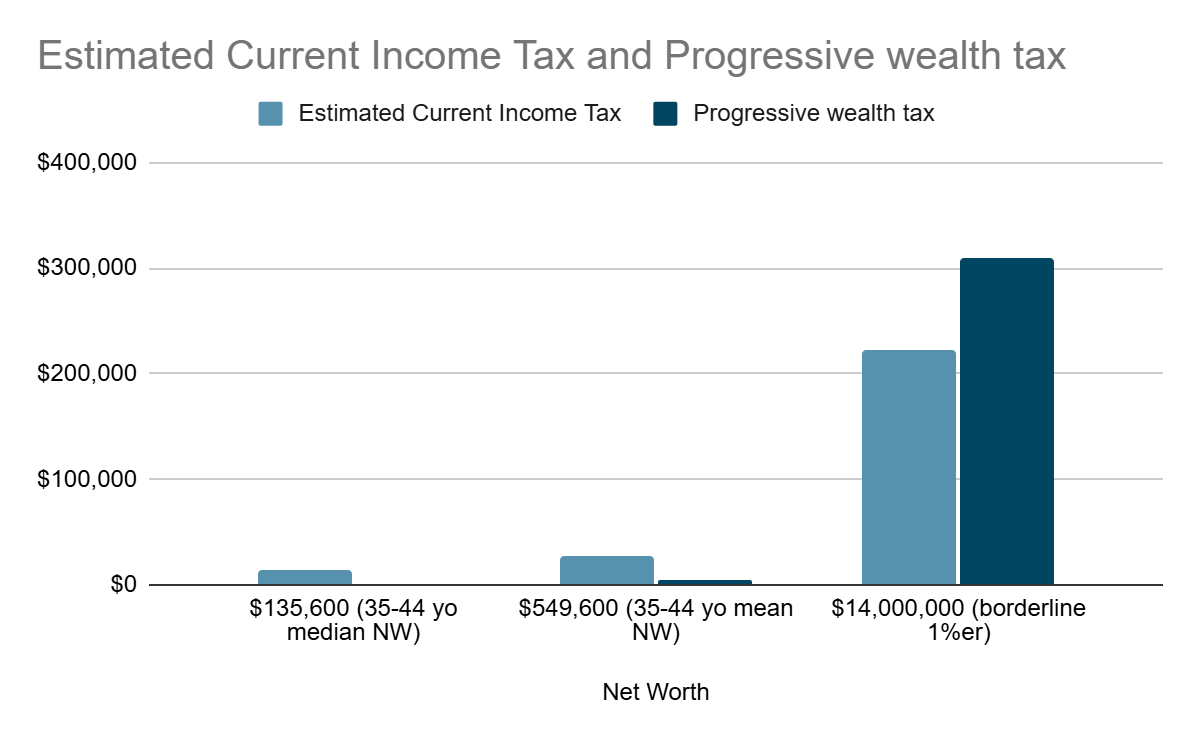

Median 35–44 yo ($135,600) |

$13,973 |

$1,356 (-90.3%) |

|

Mean 35–44 yo ($549,600) |

$26,642 |

$5,496 (-79.4%) |

|

1% Threshold ($14,000,000) |

$223,333 |

$310,000 (+38.8%) |

|

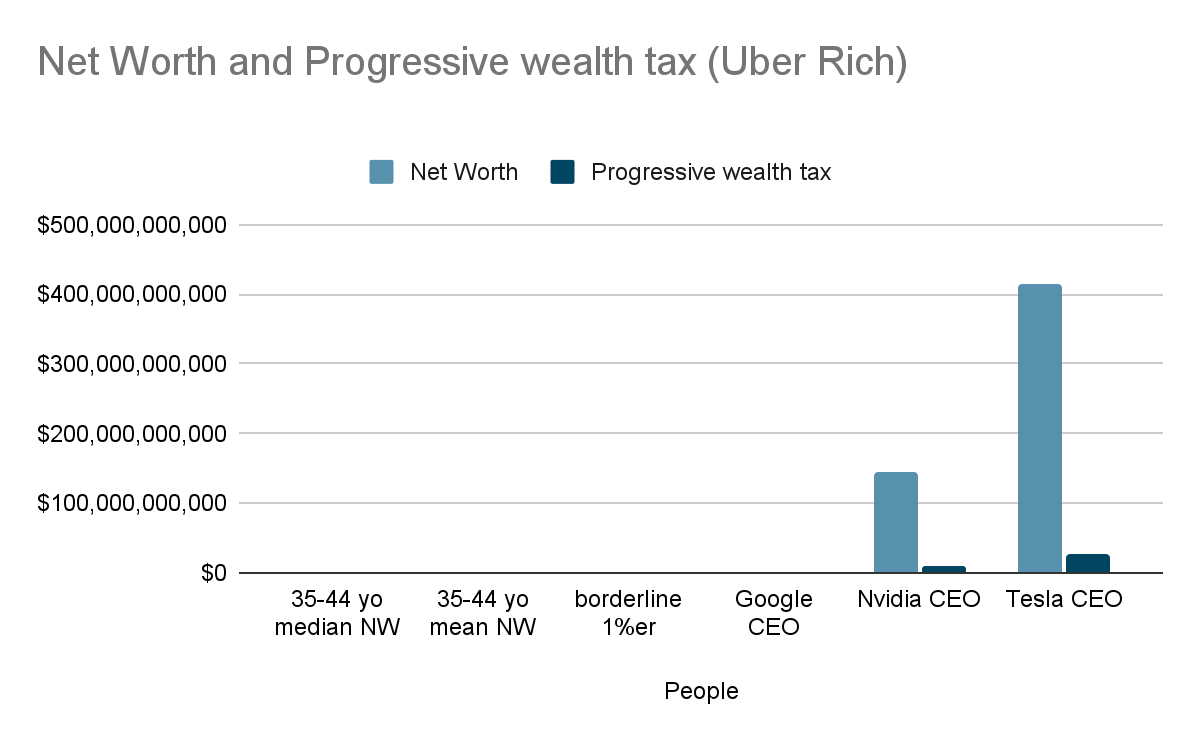

Google CEO ($1.1 billion) |

$25,077,918 |

$43,890,000 (+75%) |

|

Nvidia CEO ($145.4 billion) |

$238,090,000 |

$9,066,890,000 (+3708%) |

|

Tesla CEO ($414.6 billion) |

$476,090,000 |

$27,910,890,000 (+5763%) |

In comparison to the net worth of the top 1%, the tax paid by the average/median citizens will be almost non-existent.

This remains true even for the uber rich, as only about 6% of their total net worth gets taxed.

For the median and average net worth individuals, there will be significant reduction in tax. The 1% will see a modest increase in tax.

The uber rich will be paying far more appropriate taxes compared to before.

The estimated current income taxes are estimated by AI due to lack of publicly available data, assuming these numbers are close, there’s a massive disparity between how much the upper classes are currently paying and how much they should owe under the progressive wealth tax model. It’s also worth noting that this tax model breaks even around $11-13 million networth, so any individuals worth less than that will definitely be saving money under this new tax model.

Assuming Elon Musk’s $11 billion dollar tax in 2022 (one of Tesla’s most lucrative years) due to stock sales is true, he is still not paying nearly half as much as he should under this new model.

The following table shows the calculation breakdown when the progressive wealth tax model is applied to all US households, yielding ~$4.06 trillion.

|

Wealth Range |

Approx. Total Wealth |

Marginal Rate |

Estimated Tax Collected |

|

$0–$1M (bottom 50%) |

$3.2 trillion |

1% |

$32 billion |

|

$1 M–$10 M (next 49%) |

~$85 trillion |

2% on wealth above $1M |

~$1.68 trillion |

|

$10 M–$100 M (upper of next) |

~$20 trillion |

3% on wealth above $10M |

~$0.6 trillion |

|

$100 M–$1 B (within top 1%) |

~$10 trillion |

4% on wealth above $100M |

~$0.4 trillion |

|

$1 B–$10 B (ultra top) |

~$5 trillion |

5% on wealth above $1B |

~$0.25 trillion |

|

> $10 B (super‑ultra rich) |

~$1.6 trillion |

6–8% |

~$0.12 trillion |

|

Total (approx.) |

~$160T |

~$4.06 trillion |

Result of proposal

The projected revenue generated from this tax is estimated to be approximately $4.06 trillion. This figure far outweighs the current $2.06 trillion income tax revenue by an outstanding 202%. By making the proposed tax model swap, we would not only offset the foregone revenue, but also end up with a substantial surplus. These excesses can go into paying off our national debt and other government endeavors.

One of the most significant impacts of this new tax model is the direct neutralization of the “Buy, Borrow, Die” strategy, since this tax will ensure that unrealized gains are also subject to taxations.

This model would result in a huge relief for the lower and middle class families (up to 90% reduction in tax for the median individual), allowing them to live comfortably, afford kids and also have the breathing room to invest their money, whether that’s into education or stock market. Ultimately, this tax model gives the bottom 90% a chance to catch up on the rapidly speeding financial treadmill.

For the wealthy, these taxes are very reasonable in comparison to the massive wealth they’ve acquired from thriving in the US. In modern times, where there is a growing awareness of extreme wealth disparity, followed by violence against the wealthy and those in power, some kind of negotiation or balance needs to be achieved between the classes. This model offers an opportunity for the wealthy to pay their fair share and ultimately quell the resentment towards them, while still allowing them to retain an immense portion of their wealth.

Counter-Arguments

- Capital Flight: Wealthy individuals and their assets are highly mobile. A substantial wealth tax could incentivize them to move their wealth or even their residency to countries with more favorable tax regimes, shrinking the taxable base.

- For the wealthy, the USA continues to be one of the best countries to live in in terms of quality of life, security and prosperity. There are too few countries they can emigrate to that would outweigh the desire to avoid tax

- Few countries that may compete are Switzerland, Singapore, UAE, but they do not offer the level of connections and market that the wealthy have embedded themselves in within the USA

- USA enabled the rapid growth of wealth to begin with, whether due to domestic talents/lack of regulations/high consumptions, billionaires cannot thrive nearly as well anywhere else: USA houses 902 billionaires out of the 3000 in the world

- The US currently has a large exit tax (can be up to 20-30% of their overall holdings), which will most definitely be a bigger hit than the meager ~5% tax annual where their wealth can still grow

- Liquidity Issues: Much of the wealth of the super-rich is not held in cash but in illiquid assets. Forcing annual sales of these assets to pay taxes could disrupt markets and be economically inefficient.

- The market should hold the values of these stocks at their backed valuation (ideal state). Current state is that stocks are almost entirely speculative because the wealthy have vast majority of marketshares to manipulate the market with

- Forced gradual sell-offs can alleviate this concern, maybe collect taxes on a quarterly basis for owners of publicly traded companies

- More people having increased disposable income will result in more market participation overall, creating a more diverse stock market where all the money are not just parked within the Mag 7/S&P500 stocks

- Avoidance and Evasion: Despite the "no loopholes" intent, new forms of tax planning and potential evasion strategies often emerge in response to new taxes.

- Continuous funding of IRS and lawmakers to close out any possible loopholes will be needed, it is important to keep iterating in this aspect.

- Asset Valuation: Accurately valuing all assets (especially illiquid ones like private businesses, art, and complex financial instruments) annually is extremely difficult, costly, and prone to disputes. This could lead to lower valuations and thus lower revenue.

- Perhaps this is an opportunity to open up a whole sector of tax auditors/valuators. Ones that can help determine the valuation of these “niche” assets. This could maybe just be a department/agency within the IRS.

- Administrative Burden: Implementing and enforcing such a comprehensive wealth tax would require a massive expansion and retooling of tax agencies like the IRS, demanding significant new resources and expertise.

- We should fund the IRS, and the IRS should focus on the top 10% individuals to make sure that the taxes are being paid. There is less need to audit the vast majority of people with less than $1 million net worth since their contributions won’t be as significant

Appendix

Wealth Distribution & Inequality

- Visual Capitalist – Wealth Distribution in America

- Confirms: Top 1% owns ~30.8% of wealth; bottom 90% owns ~32.8%.

- https://www.visualcapitalist.com/wealth-distribution-in-america/

- Forbes – World’s Billionaires List 2024

- Confirms the U.S. has 902 billionaires as of 2024.

- https://www.forbes.com/billionaires

Inflation, Wages, and Living Costs

- Economic Policy Institute (EPI) – Productivity vs. Pay Gap

- Documents stagnation of wages vs. rising productivity/inflation.

- https://www.epi.org/productivity-pay-gap/

- Harvard Joint Center for Housing Studies – State of the Nation’s Housing 2024

- Tracks rising rent, home prices, and affordability issues tied to wealth inequality.

- https://www.jchs.harvard.edu/

- Kaiser Family Foundation (KFF) – Health Costs and Inequality

- Demonstrates the increasingly unaffordable nature of U.S. healthcare, especially for lower/middle classes.

- https://www.kff.org/health-costs/

Tax Structure, Enforcement, and Models

- Fiscal Data – Government Revenue

- Confirms $2.06T in income tax revenue (51% of total federal revenue).

- https://fiscaldata.treasury.gov/americas-finance-guide/government-revenue/

- CNN – Elon Musk 2022 Tax Bill ($11B)

- OECD – Global Corporate Tax Framework (15% Minimum)

- Explains why the proposal avoids corporate tax reform.

- https://www.oecd.org/en/topics/sub-issues/corporate-taxation.html

- Smart Asset – How the Rich Avoid Taxes

- Explains Buy Borrow Die

- https://smartasset.com/investing/buy-borrow-die-how-the-rich-avoid-taxes

- Fidelity – Average Networth by Age

- Provides median and mean net worth by age and household.

- https://www.fidelity.com/learning-center/smart-money/average-net-worth-by-age